<–2/”>a >In the Year 2014, Chhattisgarh ranked as the best performing state in most of the key fiscal parameters, according to a Reserve Bank of India (RBI) study. According to the study, Chhattisgarh has done reasonably well in spending its Money in developmental sector, one of the key parameters to judge States overall performance.

As per RBI study, published in its annual number, ‘State Finances – A study of budgets of 2013-14’:-

Chhattisgarh’s development expenditure as per cent of Gross State Domestic Product (GSDP) was highest in the country. In Chhattisgarh, development expenditure was 20.7 per cent of GSDP, whereas Average of all states put together was 11.4 per cent. In respect of social sector expenditure, that includes Education, Health, SC/ST development, Women and child development, Chhattisgarh was on the first position. In debt sustainability, boosting Growth in state revenue or acquisition of fixed assets (capital outlay) to GSDP, Chhattisgarh has done well, the study said.

State of the economy:-

- According to 14th Planning Commision, During the last two plan periods, Chhattisgarh had achieved a growth rate comparable to national level. For the first two years of Twelfth plan, its growth rate had been better than that of all India. Primary Sector provides sustenance to nearly 80 per cent of the Population and contributes nearly 30 per cent to GSDP. However, with 70 per cent area under rain-fed agriculture, uncertain monsoon conditions affect the income of rural population.

- The contribution of Secondary Sector to the GSDP has, in recent years, declined in terms of Percentage, despite the fact that the state is very rich in mineral Resources. The decline is mainly on account of continuing slowdown in the manufacturing sector. Tertiary Sector has increased its share in the GSDP; the growth however is constrained by low per capita income.

- Chhattisgarh continues to have relatively low per capita income which is less than half of Gujarat, Maharastra, Haryana, Kerala, and Tamilnadu, among the major states. Worst still, during the last ten years, the inter-state disparity in the per capita income has widened further. POVERTY estimates released by Planning Commission in July 2013 reveals that Chhattisgarh has the highest percentage of persons living below Poverty Line (39.93 per cent).

Fiscal Situation:-

Chhattisgarh passed the Financial Responsibility and Budget Management Act (FRBM) in 2005. Earlier, the Central Government passed the Act in 2003. Among the objectives of this legislation has been fiscal transparency, conduct of Fiscal Policy in medium term framework, and long term macro-economic stability. In concrete terms, a roadmap was to be prepared to bring down the Revenue Deficit of the Central Government to zero by March 2008 and Fiscal Deficit to be brought down to less than 3 per cent of GDP. However, this has not happened. Revenue and fiscal deficits of the Centre have continued to surge, breaching the 3% ceiling. The State has adhered to the targets set out under its FRBM Act. However, the fiscal performance of the states is dependent on the performance of the Central Government. Accordingly, macro-economic management of the Centre affects the states’ budgetary resources and expenditure. A mechanism has, therefore, to be evolved to ensure that the Central Government follows the discipline it imposes on the states. 14th finance Commision suggested the 3 per cent ceiling prescribed for fiscal deficit under FRBM Act needs to be relaxed for states like Chhattisgarh, keeping in view the present level of debt sustainability and also the massive investments requirements of the State. The state should therefore be allowed the flexibility to go for sustainable borrowings as per its development requirements. If this suggestion is not acceptable, the borrowing ceiling may be upscaled to 5 percent of GSDP. However Performance of the State has been good in fiscal management:-

- Chhattisgarh has been rated among the best performing states in fiscal management in the RBI Study of State Finances. It has consistently achieved a relatively high tax GSDP ratio of 8 per cent which ranks it among the top four states, a healthy tax buoyancy of 1.6 and has generated uninterrupted revenue surplus. Its debt GSDP as well as interest payment-GSDP ratio continues to be the lowest among the non-special category states.

- The problem had been compounded by the shortfall in fiscal transfers from the centre due to its falling Revenue Receipts, coupled with hardening of cost of borrowing for the states because of excess market borrowing by the centre to finance its uncontrolled deficits, thereby adversely affecting the available resources for financing its developmental needs. In effect, the State’s finances were under severe Stress, making it difficult for the government to adhere to FRBM targets. It ended up FY 2013-14 with a revenue deficit of Rs. 726 crore, a situation arising after a gap of ten successive years of revenue surplus, mainly because of shortfall of Rs.713 crore in share of central taxes.

- In addition, Centre’s recent decision to set up the Seventh Central Pay Commission would also impact States’ finances, spreading over the Commission’s award period, which have not been factored by any State. This aspect needs to be kept in mind while determining States’ share in the divisible pool.

Therefore, there is a strong case for adequate financial support to the state so as to achieve a greater degree of equalization in providing a standard level of Public Service and step up its growth momentum.

Deficits, Debts and FRBM Targets for 2017-18:-

The Fiscal Responsibility and Budget Management (FRBM) Act, 2005 of Chhattisgarh provides annual targets to progressively reduce the outstanding liabilities, revenue deficit and fiscal deficit of the State Government.

Revenue deficit:

It is the excess of Revenue Expenditure over revenue receipts. A revenue deficit implies that the government needs to borrow in order to finance its expenses which do not create capital assets. However, the budget estimates a revenue surplus of Rs 4,781 crore (or 1.73% of GSDP) in 2017-18. This implies that revenue receipts are expected to be higher than the revenue expenditure, resulting in a surplus. The estimate indicates that the state is meeting the target of eliminating revenue deficit, as prescribed by the 14th Finance Commission.

Fiscal deficit:

It is the excess of total expenditure over total receipts. This gap is filled by borrowings by the government, and leads to an increase in total liabilities of the government. A high fiscal deficit may imply a higher repayment obligation for the state in the future. In 2017-18, fiscal deficit is estimated to be Rs 9,647 crore, which is 3.49% of the GSDP. During 2016-17, fiscal deficit is estimated to be Rs 7,688 crore, which is 2.92% of GSDP, higher than the budget estimate of 2.88%.

Outstanding Liabilities: It is the accumulation of borrowings over the years. In 2017-18, the outstanding liabilities are expected at 18.47% of GSDP.

Receipts in 2017-18:-

- The total revenue receipts for 2017-18 are estimated to be Rs 66,094 crore, an increase of 5.3% over the revised estimates of 2016-17.

- State’s tax revenue is expected to increase by 3% (Rs 687 crore) in 2017-18 over the revised estimates of 2016-17. The tax to GSDP ratio is targeted at 8.5% in 2017-18, which is lower than the revised estimate of 8.7% in 2016-17. This implies that growth in collection of taxes is expected to be lower than the economic growth estimated.

- Non-tax revenue in 2017-18 is estimated to increase by 2.4% (Rs 184 crore) over the revised estimates of 2016-17. Chhattisgarh’s interest earnings are expected to reduce by 43% from the revised estimates of 2016-17, to Rs 143 crore.

- Grants from the centre are expected to increase by 2.8%, from Rs 13,722 crore in 2016-17 (RE), to Rs 14,101 crore in 2017-18. The other component of transfers from the centre is the state’s share in central taxes, which is estimated to increase by 10.9%, to Rs 20,868 crore in 2017-18.

Tax Revenue: Sales Tax is expected to be the largest component (57%) of the tax revenue, with an estimated collection of Rs 13,445 crore. Sales Tax collections are expected to increase by 8% over the revised estimates of 2016-17. Note that GST is expected to be introduced in 2017-18. It will subsume taxes such as Sales Tax and Entertainment Tax (unless levied by local bodies). Whether the roll-out of GST will increase tax collections will become clear in due course of time. Rs 3,169 crore is expected to be generated from the levy of Excise Duty. In addition, Rs 1,767 crore will be collected by levying taxes on entry of goods and passengers.

Non Tax Revenue: Chhattisgarh has estimated to generate Rs 7,704 crore through non-tax sources in 2017- 18. This includes Rs 5,600 crore through mining and metallurgical industries.

,

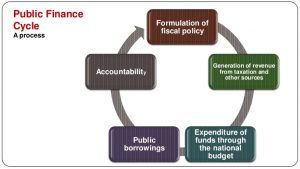

Public finance is the study of the government’s revenue and expenditure. It is concerned with how the government raises money and how it spends that money. Public finance is a subfield of economics, and it is closely related to public policy.

Public revenue is the money that the government collects from taxes, fees, and other sources. Public expenditure is the money that the government spends on goods and Services, such as education, healthcare, and Infrastructure-2/”>INFRASTRUCTURE.

Tax revenue is the most important source of public revenue. Taxes are compulsory payments that are levied by the government on individuals and businesses. There are many different Types of Taxes, including income taxes, sales taxes, and property taxes.

Non-tax revenue is revenue that is not collected from taxes. Non-tax revenue includes fees, fines, and interest income.

Public expenditure is divided into two categories: Capital Expenditure and recurrent expenditure. Capital expenditure is spending on long-term assets, such as roads, bridges, and schools. Recurrent expenditure is spending on day-to-day operations, such as salaries and wages.

Fiscal Policy

Fiscal policy is the use of government spending and Taxation to influence the economy. Fiscal policy is one of the two main tools that governments use to manage the economy, along with Monetary Policy.

Fiscal policy can be used to stimulate the economy during a Recession or to slow down the economy during an inflationary period. Fiscal policy can also be used to redistribute income or to promote economic growth.

There are two main types of fiscal policy: expansionary fiscal policy and contractionary fiscal policy. Expansionary fiscal policy is designed to increase Aggregate Demand in the economy. This can be done by increasing government spending or by cutting taxes. Contractionary fiscal policy is designed to decrease aggregate demand in the economy. This can be done by decreasing government spending or by raising taxes.

Fiscal Responsibility and Budget Management Act

The Fiscal Responsibility and Budget Management Act (FRBM) is an act of the Parliament of India that was enacted in 2003. The FRBM Act is designed to promote fiscal discipline and transparency in the management of the government’s finances.

The FRBM Act sets out a number of fiscal targets that the government is required to meet. These targets include a limit on the fiscal deficit, a limit on the Public Debt, and a limit on the revenue deficit.

The FRBM Act also requires the government to publish a medium-term fiscal policy statement and an annual budget statement. These statements must provide information on the government’s fiscal plans and projections.

Fiscal consolidation is a process of reducing the government’s budget deficit. Fiscal consolidation can be achieved through a combination of spending cuts and tax increases.

Fiscal consolidation is often necessary when the government’s budget deficit is too large. A large budget deficit can lead to a number of problems, such as high interest rates, Inflation, and currency depreciation.

Fiscal consolidation can be a difficult process, as it often requires unpopular measures, such as cuts to social programs or increases in taxes. However, fiscal consolidation is often necessary to ensure the long-term sustainability of the government’s finances.

Fiscal Transparency

Fiscal transparency is the openness and clarity with which the government reports its financial information. Fiscal transparency is important because it allows citizens and investors to hold the government accountable for its spending and borrowing.

Fiscal transparency can be achieved through a number of measures, such as publishing regular budget reports, disclosing the government’s debt levels, and allowing independent audits of the government’s finances.

Fiscal transparency is essential for Good Governance and for ensuring the long-term sustainability of the government’s finances.

What is public finance?

Public finance is the study of the government’s revenue and expenditure. It includes the study of how the government raises money, how it spends money, and how it manages its debt.

What is fiscal policy?

Fiscal policy is the use of government spending and taxation to influence the economy. It is one of the two main tools that governments use to manage the economy, along with monetary policy.

What are the goals of public finance?

The goals of public finance are to provide public goods and services, to redistribute income, and to stabilize the economy.

What are the sources of government revenue?

The main sources of government revenue are taxes, fees, and fines.

What are the types of taxes?

There are many different types of taxes, but the most common are income taxes, sales taxes, and property taxes.

What are the expenditures of government?

The main expenditures of government are on goods and services, Transfer Payments, and debt service.

What is the budget deficit?

The budget deficit is the difference between government revenue and expenditure.

What is the national debt?

The national debt is the total amount of money that the government owes.

What is the public debt?

The public debt is the total amount of money that the government owes to the public.

What is the difference between the budget deficit and the national debt?

The budget deficit is the difference between government revenue and expenditure in a single year. The national debt is the total amount of money that the government owes, which includes the budget deficits of previous years.

What is the relationship between public finance and fiscal policy?

Public finance is the study of the government’s revenue and expenditure, while fiscal policy is the use of government spending and taxation to influence the economy. Public finance is the foundation of fiscal policy, as it provides the information that policymakers need to make decisions about how to use government spending and taxation to achieve their economic goals.

What are the challenges of public finance?

The challenges of public finance include the need to raise enough revenue to fund government programs, the need to distribute that revenue fairly, and the need to manage the government’s debt.

What are the future trends in public finance?

The future trends in public finance include the aging population, the increasing cost of healthcare, and the need to reduce the national debt.

Which of the following is not a source of revenue for the Chhattisgarh government?

(A) Taxes

(B) Non-tax revenue

(C) Loans

(D) GrantsThe Chhattisgarh government’s expenditure is classified into which of the following categories?

(A) Revenue expenditure

(B) Capital expenditure

(C) Both revenue and capital expenditure

(D) None of the aboveThe Chhattisgarh government’s budget is prepared by which of the following bodies?

(A) The Finance Department

(B) The Planning Department

(C) The Public Accounts Committee

(D) The Legislative AssemblyThe Chhattisgarh government’s budget is presented in which of the following houses of the legislature?

(A) The Legislative Assembly

(B) The Legislative Council

(C) Both the Legislative Assembly and the Legislative Council

(D) None of the aboveThe Chhattisgarh government’s budget is debated and passed by which of the following houses of the legislature?

(A) The Legislative Assembly

(B) The Legislative Council

(C) Both the Legislative Assembly and the Legislative Council

(D) None of the aboveThe Chhattisgarh government’s budget is implemented by which of the following bodies?

(A) The Finance Department

(B) The Planning Department

(C) The Public Accounts Committee

(D) The State Planning BoardThe Chhattisgarh government’s budget is audited by which of the following bodies?

(A) The Comptroller and Auditor General of India

(B) The Public Accounts Committee

(C) The State Planning Board

(D) The Legislative AssemblyThe Chhattisgarh government’s budget is a statement of the government’s financial plans for the coming year.

(A) True

(B) FalseThe Chhattisgarh government’s budget is a reflection of the government’s priorities.

(A) True

(B) FalseThe Chhattisgarh government’s budget is a tool for Economic Development.

(A) True

(B) False