-

ETS Defined: An Emissions Trading Scheme (ETS) is a market-based regulatory tool to reduce air pollution by incentivizing emission reductions through tradable permits. It sets a cap on total emissions.

-

How it works: Industries receive/purchase emission permits (“allowances”). Cleaner industries can sell excess permits to those exceeding limits. Called “cap-and-trade”.

-

Surat ETS Significance: World’s first ETS focused on particulate pollution (not CO2) and India’s first emissions market for any pollutant. Targeted 342 industries in Surat, primarily textiles.

-

Surat ETS Design: A cap on total particulate matter emissions was set and later tightened. Permits were issued, mostly for free initially, with auctions for a portion. Price floor and ceiling maintained stability.

-

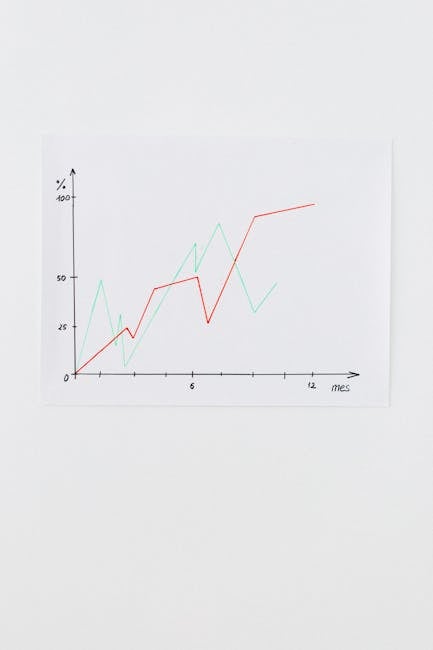

Surat ETS Results: Plants under ETS reduced emissions more than those under conventional regulation, complied with permits. Non-ETS plants often failed to meet norms.

-

ETS Criticism:

- Over-allocation of permits can keep prices low, hindering investment in cleaner tech.

- Lobbying can delay tightening of caps.

- Using emission intensity instead of absolute caps can be problematic.

- Markets have sometimes disproportionately affected disadvantaged communities.

-

ETS Aim: To address

monitoring and enforcement gaps in command-and-control systems by offering flexibility and incentives for compliance.